With great pleasure, we will explore the intriguing topic related to Interest Rate Projection 2025: A Comprehensive Outlook. Let’s weave interesting information and offer fresh perspectives to the readers.

Interest rates play a crucial role in the economy, influencing investment, consumption, and overall economic activity. Central banks, such as the Federal Reserve in the United States, use interest rate adjustments as a primary monetary policy tool to manage inflation, stabilize economic growth, and maintain financial stability. Understanding the trajectory of interest rates is essential for businesses, investors, and policymakers to make informed decisions. This article provides a comprehensive projection of interest rates in 2025, based on an analysis of current economic conditions, market trends, and expert forecasts.

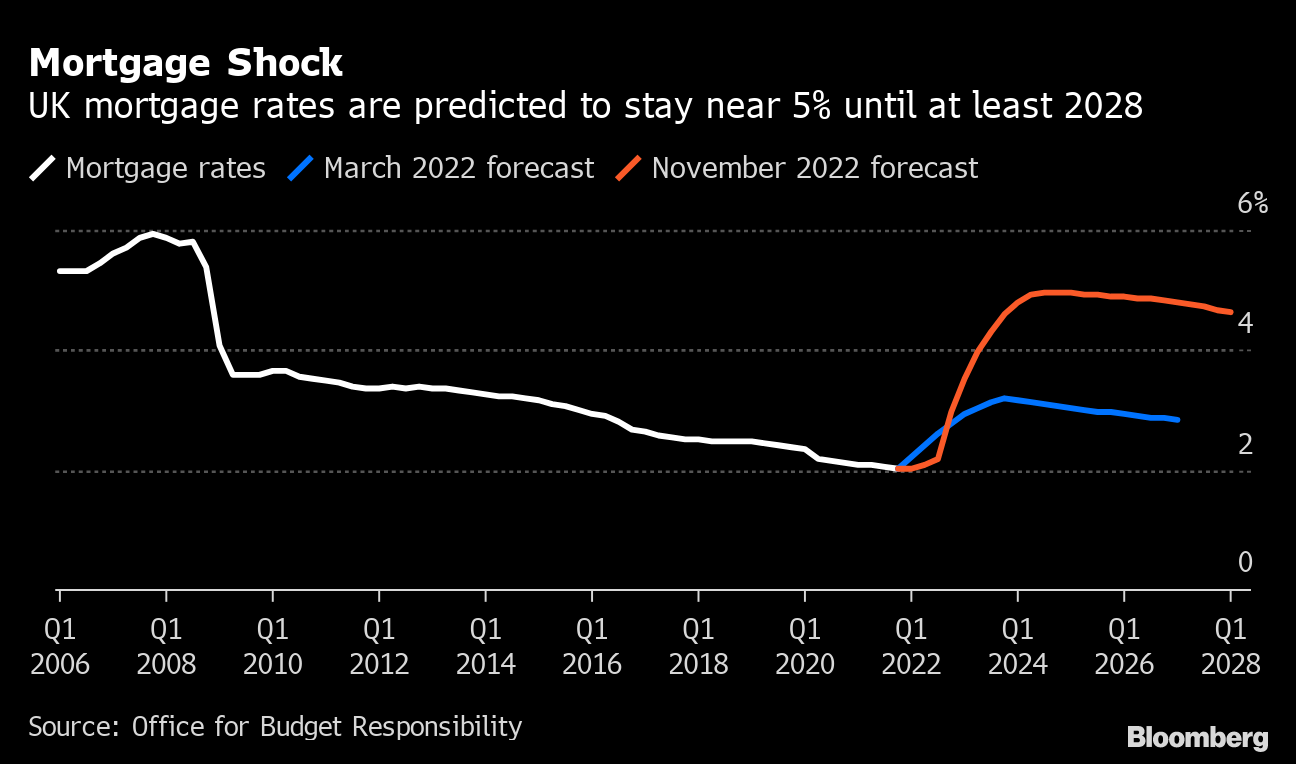

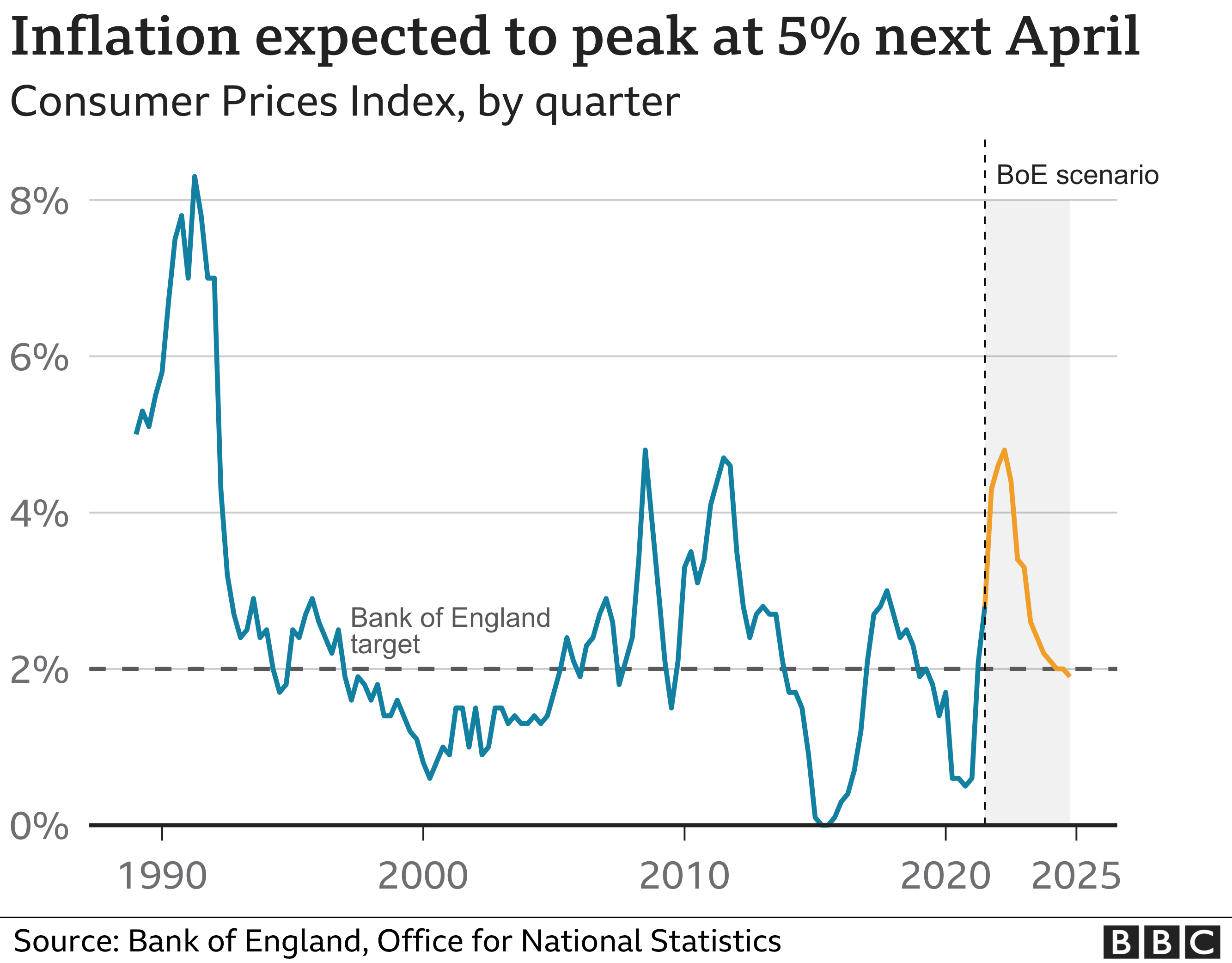

The global economy is currently facing a confluence of challenges, including the ongoing COVID-19 pandemic, supply chain disruptions, geopolitical tensions, and rising inflation. These factors have contributed to a period of heightened uncertainty and volatility in financial markets. Central banks worldwide have responded by raising interest rates to combat inflation and support economic recovery.

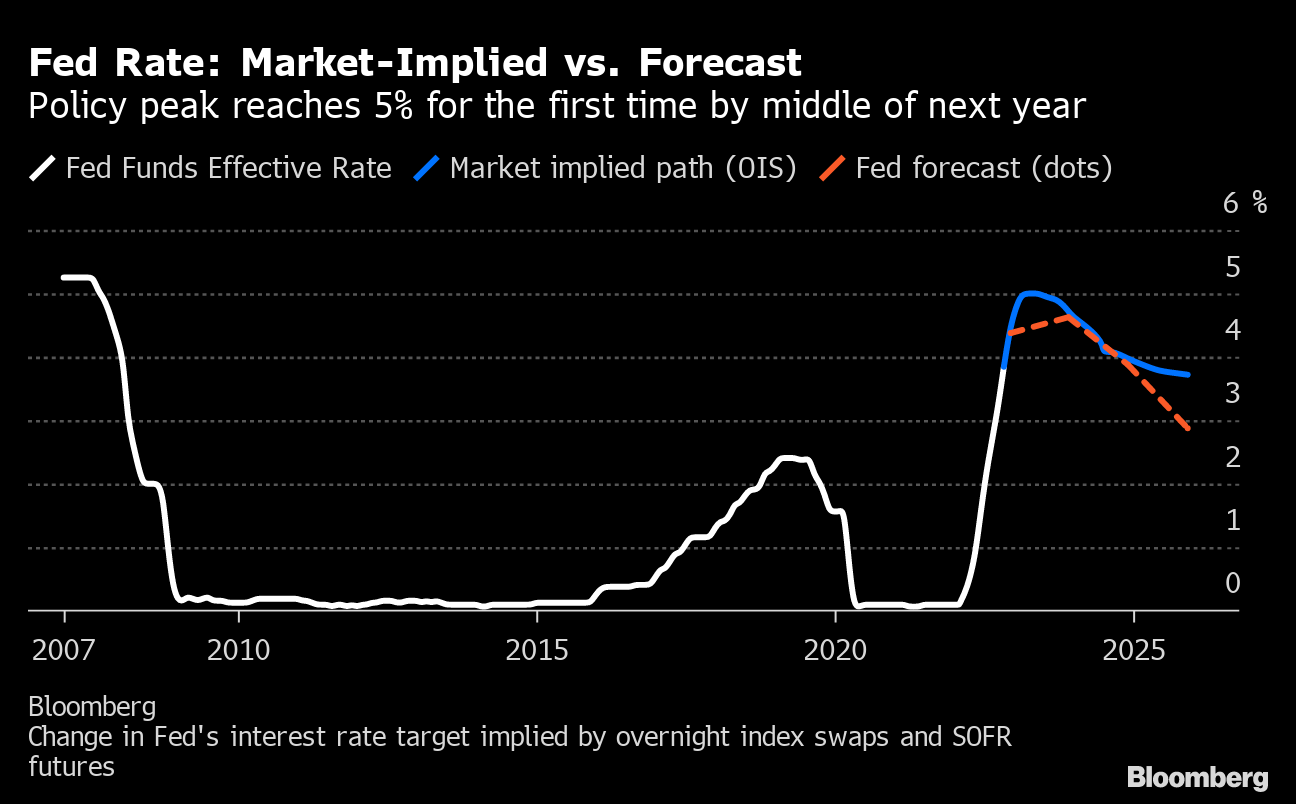

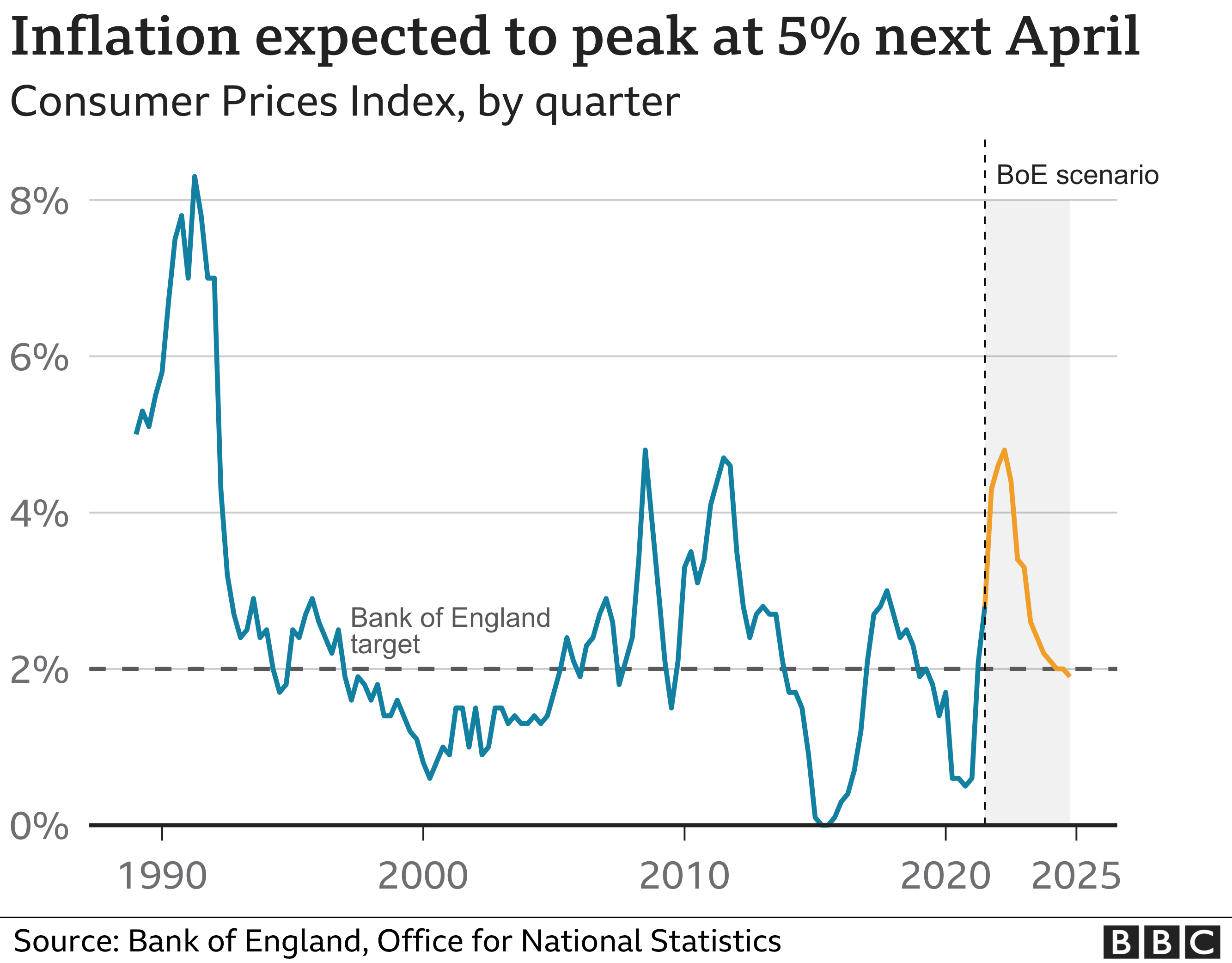

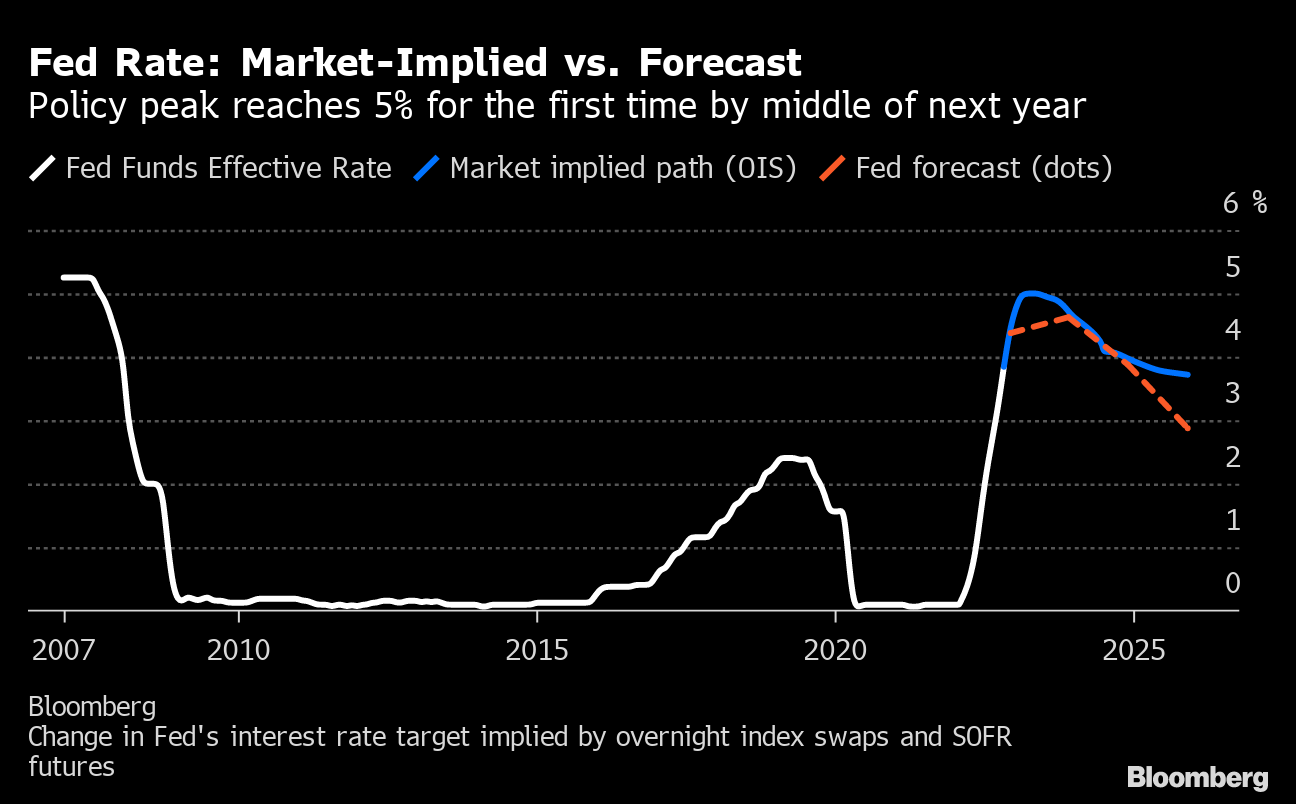

The Federal Reserve has adopted a hawkish stance on monetary policy, signaling its commitment to bringing inflation under control. The central bank has already implemented several interest rate hikes in 2022 and has indicated that further increases are likely in the coming months. Market participants expect the Fed to continue raising rates until inflation falls back to its target of 2%.

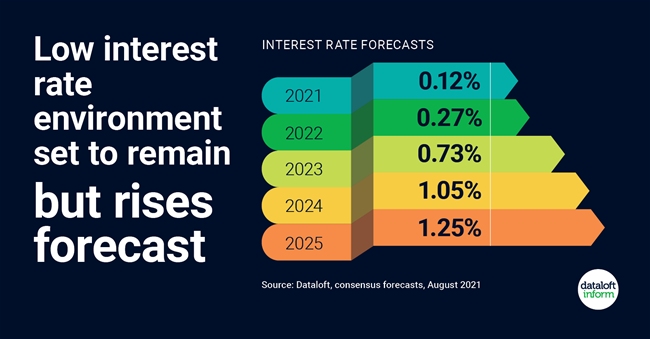

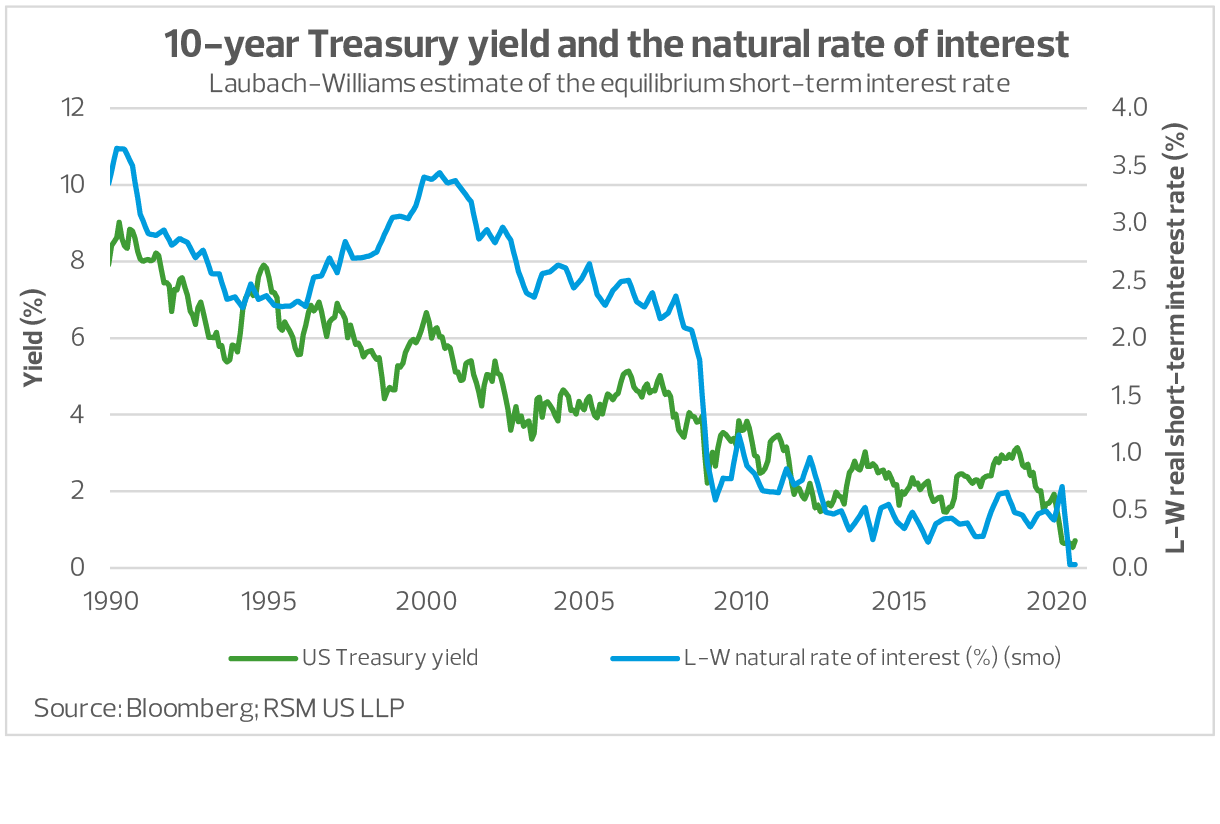

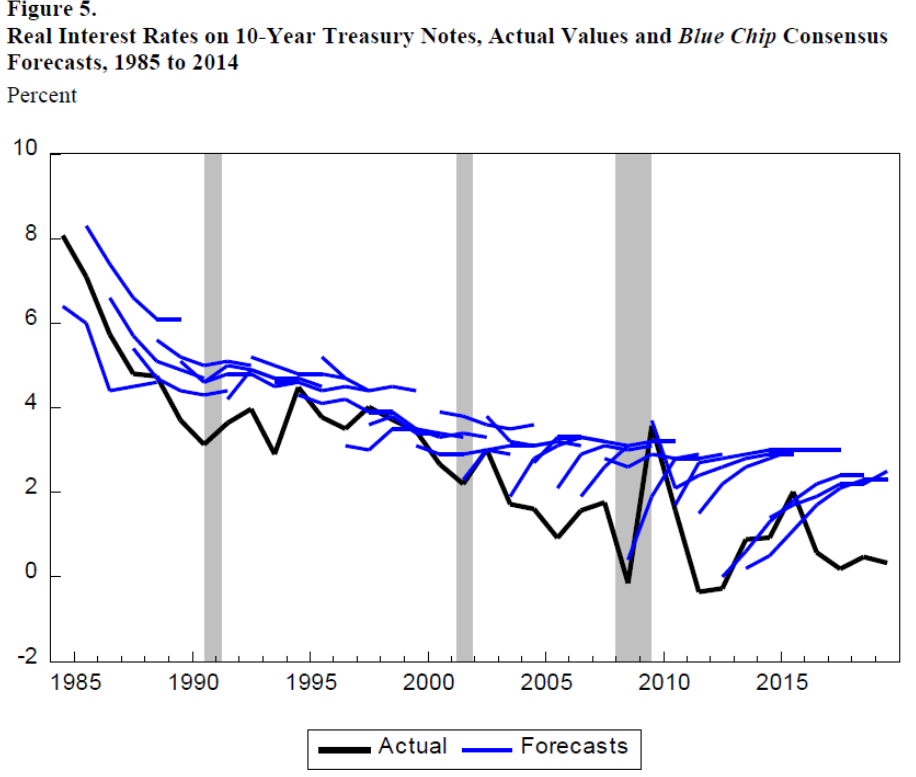

According to the latest survey of market participants conducted by Bloomberg, the median forecast for the federal funds rate at the end of 2025 is 3.5%. This suggests that the market anticipates the Fed will raise rates by approximately 1.5% over the next three years. However, there is considerable uncertainty surrounding this projection, with some analysts predicting higher rates and others expecting a more moderate pace of tightening.

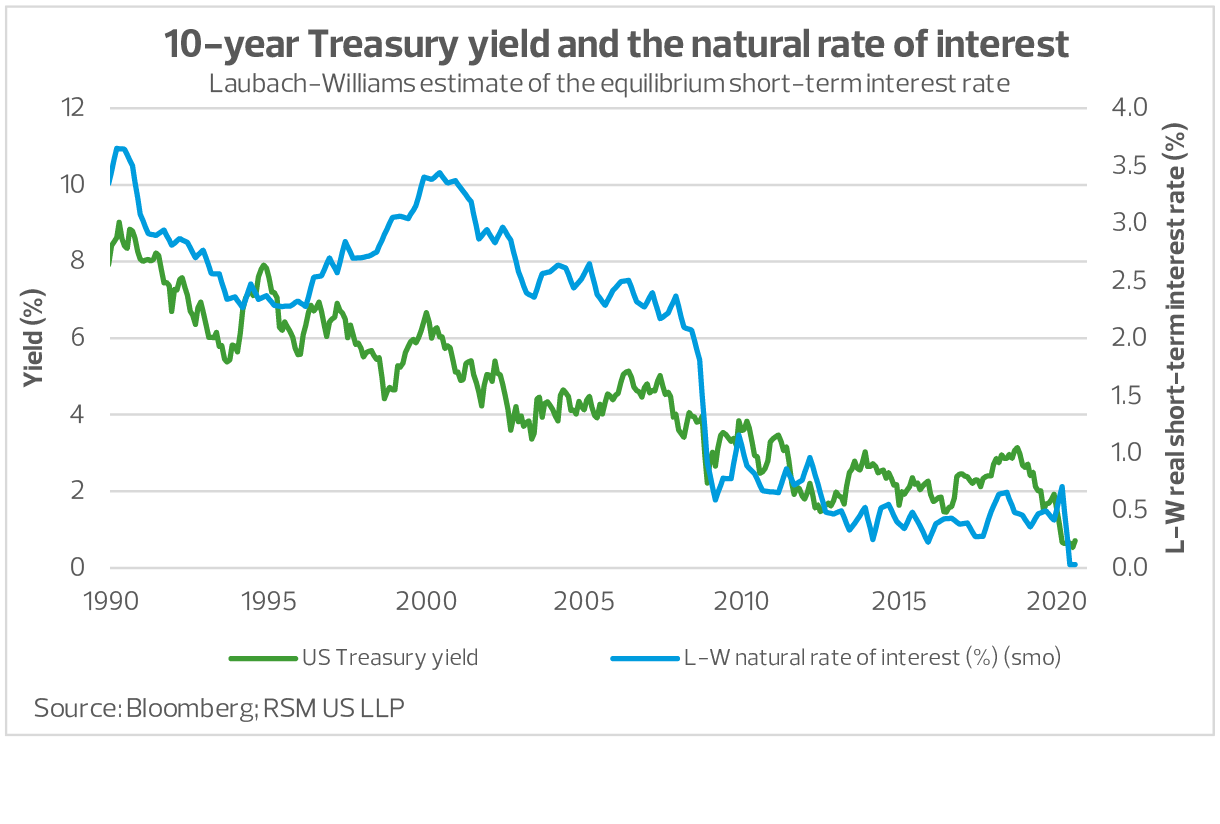

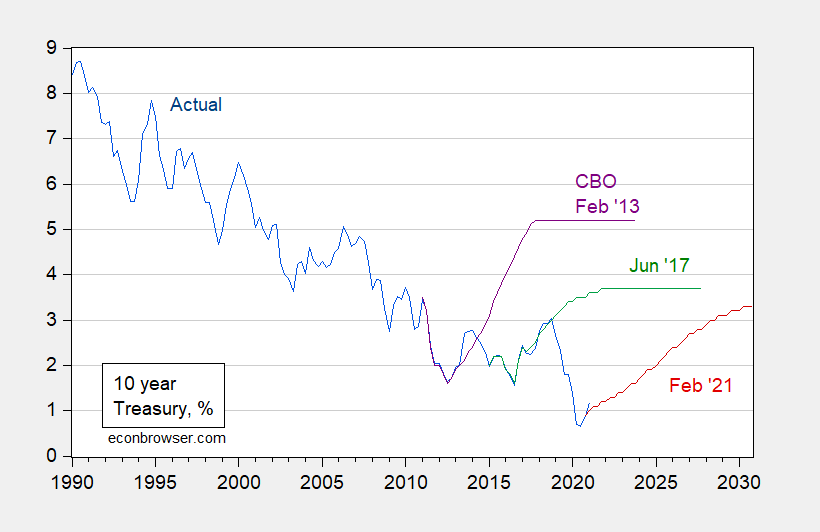

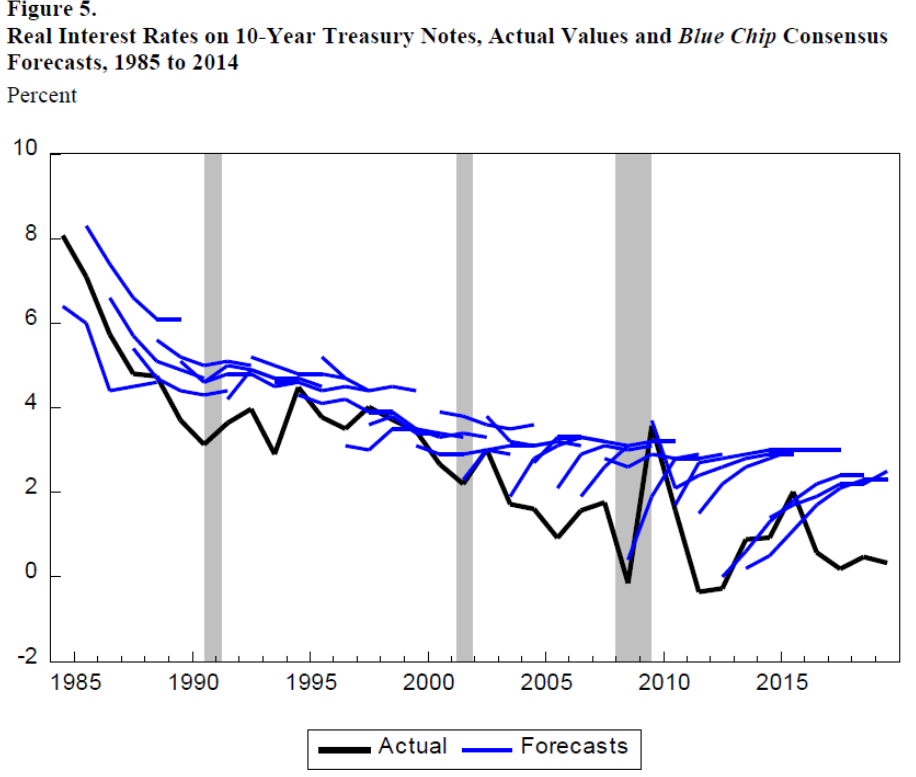

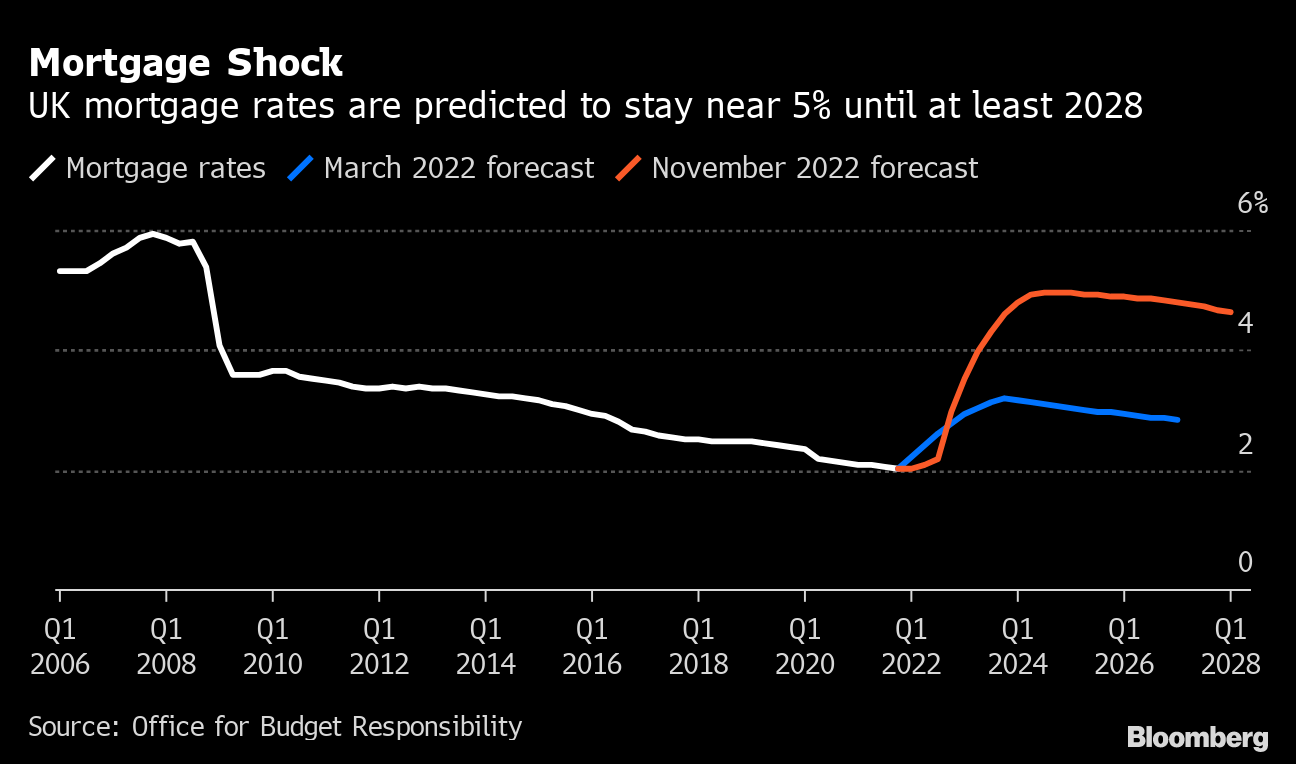

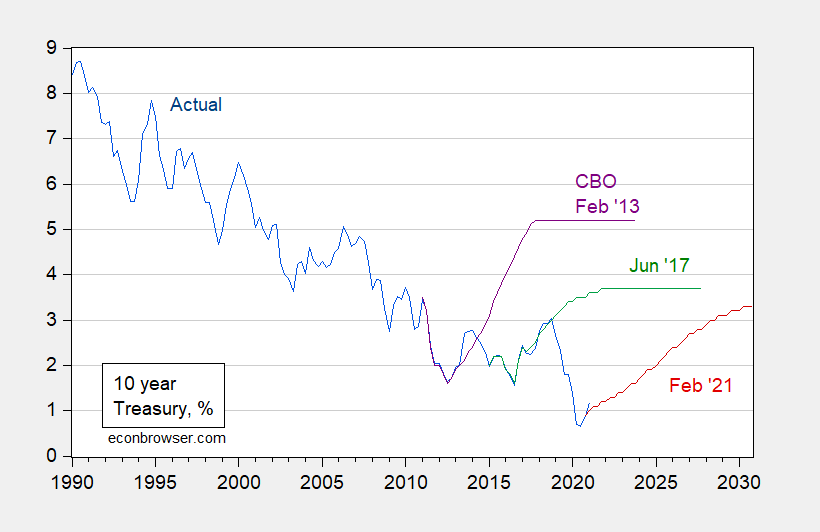

In addition to the short-term interest rate projections discussed above, it is also important to consider the long-term outlook for interest rates. Historically, interest rates have tended to move in cycles, with periods of high rates followed by periods of low rates. The current period of rising rates is likely to continue for some time, but it is eventually expected to give way to a period of lower rates in the future.

The projected interest rate trajectory has significant implications for businesses and investors. Businesses should prepare for higher borrowing costs in the near term, which could impact investment and expansion plans. Investors should consider adjusting their portfolios to reflect the changing interest rate environment, potentially shifting towards investments that are less sensitive to rate fluctuations.

Interest rate projections are crucial for understanding the future economic landscape. While there is always uncertainty involved in forecasting, the analysis presented in this article provides a comprehensive outlook for interest rates in 2025. By considering the factors influencing interest rate decisions and the long-term outlook, businesses and investors can make informed decisions and prepare for the changing economic environment.

Thus, we hope this article has provided valuable insights into Interest Rate Projection 2025: A Comprehensive Outlook. We hope you find this article informative and beneficial. See you in our next article!